Roth ira growth calculator

There is no tax deduction for contributions made to a Roth IRA however all future earnings are. Creating a Roth IRA can make a big difference in your retirement savings.

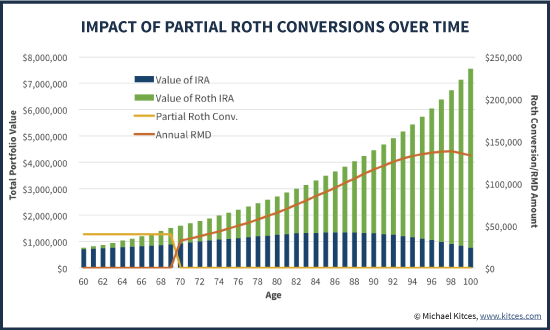

Systematic Partial Roth Conversions Recharacterizations

As of January 2006 there is a new type of 401 k -- the Roth 401 k.

. Ad Access Premium Research And Tools. Community and investing resources are waiting for you here. For 2022 the maximum annual IRA.

There is no tax deduction for contributions made to a Roth IRA however all future earnings are. Married filing jointly or head of household. However this account is different from a traditional IRA because you contribute after-tax.

Not everyone is eligible to contribute this. Ad Its a rough ride for many investors but theres plenty to like about these 5 stocks. Do Your Investments Align with Your Goals.

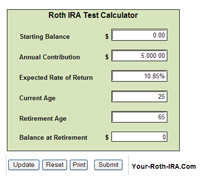

Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. The Roth 401 k allows contributions to. Learn About 2021 Contribution Limits Today.

Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. This calculator assumes that you make your contribution at the beginning of each year.

The amount you will contribute to your Roth IRA each year. Calculate your earnings and more. Not sure how to get started.

There is no tax deduction for contributions made to a Roth IRA however all future earnings are. Open An Account In 10 Minutes. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track.

For the purposes of this calculator we assume that. The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you. Use this Roth IRA calculator to find out if this is the right investment option for you.

Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation. The Roth IRA can provide truly tax-free growth. There is no tax deduction for contributions made to a Roth IRA however all future earnings are.

A 401 k can be an effective retirement tool. Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. Roth IRA Calculator Creating a Roth IRA can make a big difference in your retirement savings.

A Full-Service Experience Without the Full-Service Price. Find a Dedicated Financial Advisor Now. Creating a Roth IRA can make a big difference in your retirement savings.

Creating a Roth IRA can make a big difference in your retirement savings. Ad A Rule of Thumb Is That Youll Need 10 Times Your Income at Retirement. Save for Retirement by Accessing Fidelitys Range of Investment Options.

Roth IRA Calculator Creating a Roth IRA can make a big difference in your retirement savings. There is no tax deduction for contributions made to a Roth IRA however all future earnings are sheltered from. Married filing jointly or head of household.

Roth IRA Calculator Creating a Roth IRA can make a big difference in your retirement savings. Calculate your earnings and more. Discover The Benefits Of A Roth IRA.

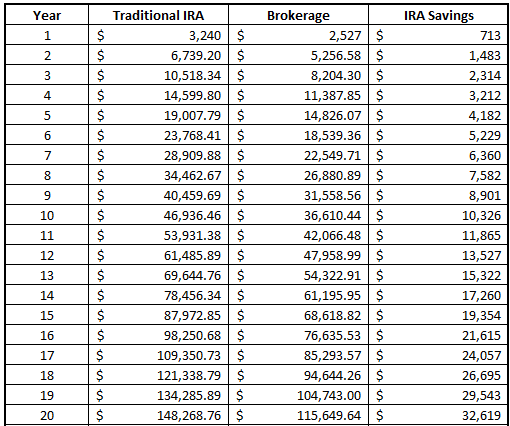

Traditional IRA calculator and other 401k calculators to help consumers determine the best option for retirement savings. Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. 1001 Liberty Ave Pittsburgh PA 15222-3779.

This calculator assumes that you make your contribution at the beginning of each year. For 2022 the maximum annual IRA. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. The amount you will contribute to your Roth IRA each year. A Retirement Calculator To Help You Plan For The Future.

Save for Retirement by Accessing Fidelitys Range of Investment Options. For 2022 the maximum annual IRA. This calculator assumes that you make your contribution at the beginning of each year.

Open An Account Online In As Little As 10 Minutes. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. A Roth IRA is also a retirement account that you open and fund yourself not through an employer.

The amount you will contribute to your Roth IRA each year. For the purposes of this. While long-term savings in a Roth IRA may.

If youre ready to maximize your retirement savings with the tax-free growth that a Roth IRA can.

Roth Ira Calculator Roth Ira Contribution

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

Best Roth Ira Calculators

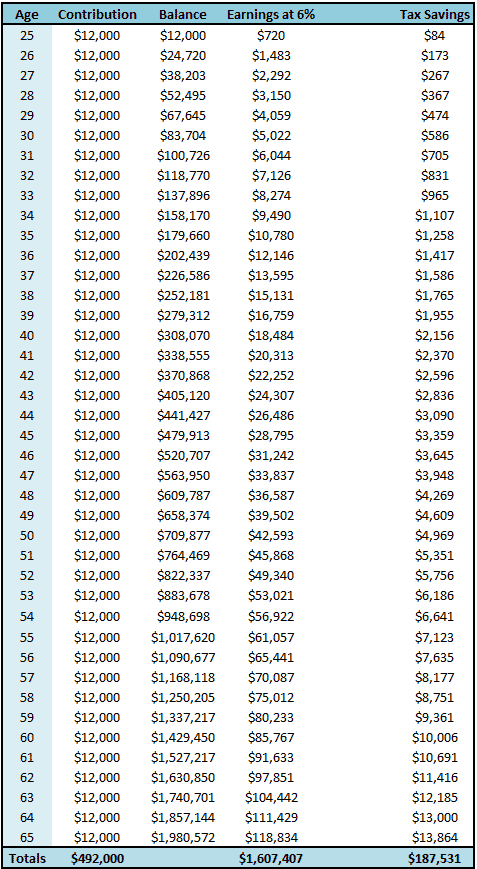

Roth Ira So Let S Say You Put Away The Maximum 5 500 Each Year And Continue To Put Away That Amount Adjusted For Inflation Wealth Building Roth Ira Wealth

Calculator Do You Have Too Much In Your Roth R Financialindependence

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq

Historical Roth Ira Contribution Limits Since The Beginning

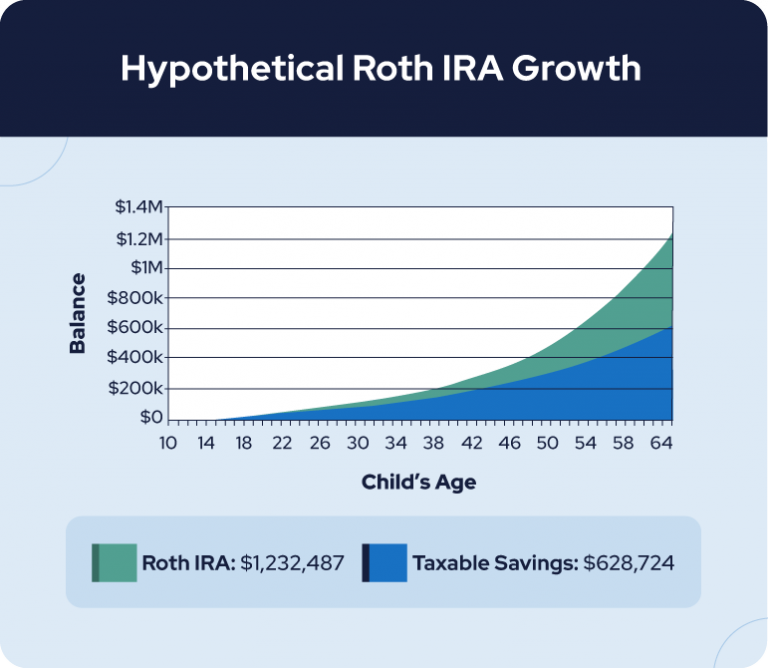

Roth Ira For Kids Make Your Grandchildren Millionaires Retireguide

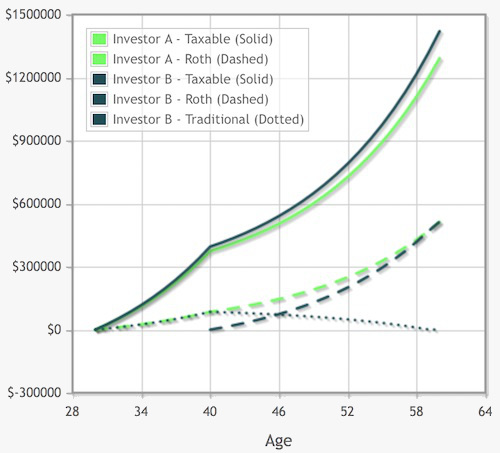

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

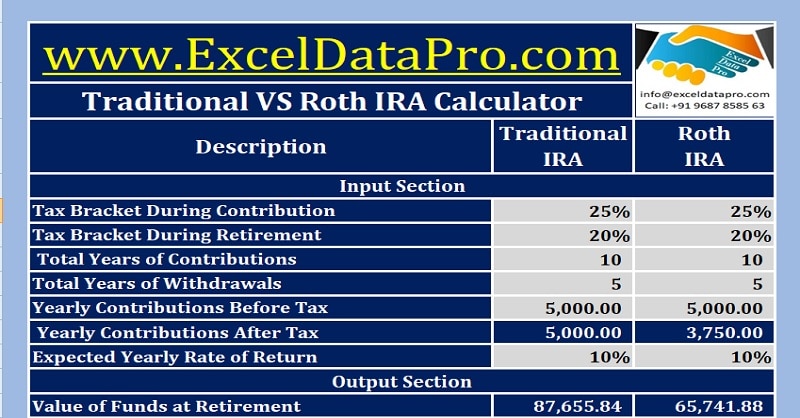

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Ira Calculator See What You Ll Have Saved Dqydj

Ira Kids Compound Interst Growth Of Roth Iras A Kid S Key To Future Wealth

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

Traditional Vs Roth Ira Calculator

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator