18+ Assumable mortgage

An assumable mortgage allows someone to find a house they want to buy and take over the sellers existing home loan without applying for a new mortgage. An assumable mortgage allows a buyer to take over or assume the sellers home loan.

2

Get Your VA Loan.

. Ad We Offer Competitive Fixed RatesFees Online Tools - Start Today. Ad Top Home Loans. According to our mortgage calculator which you can use to model your own scenario.

Fast VA Loan Preapproval. When interest rates rise an. Trusted VA Loan Lender of 300000 Veterans Nationwide.

An assumable mortgage is a mortgage that can be transferred from the current owner of the property to the buyer with the terms that were agreed upon originally. FHA loans If you want to. That means a buyer with 3.

An assumable mortgage allows the buyer to purchase a home by taking over the sellers existing mortgage loan. So lets see how that 570K sale would look like with a mortgage assumption. The buyer takes over the loans rate repayment period current principal balance.

You keep the sellers. Conventional loans such as the ever popular 30-year-loans are not assumable. Secure Todays Rate Now While You Continue to Shop For Your Dream Home Of Tomorrow.

There may be a. An assumable mortgage is an arrangement in which an outstanding mortgage and its terms can be transferred from the current owner to a buyer. Assuming a mortgage simply means that in a home sale transaction the buyer takes over the existing mortgage held by the seller including the loans outstanding balance.

Contact a Loan Specialist. Buyers often choose Assumable mortgages especially when the interest rate has gone down since the seller originally purchased the home since they can take advantage of financing. If youre offered an assumable mortgage at 26 youd likely be over the moon.

See reviews photos directions phone numbers and more for the best Mortgages in Los Angeles CA. See reviews photos directions phone numbers and more for the best Mortgages in Los Angeles CA. Once the loan is assumed by the buyer the seller is no longer responsible for repaying it.

VA Loan Expertise Personal Service. An assumable mortgage is a mortgage that can be transferred from a seller to a buyer. This allows buyers to bypass the traditional mortgage process.

In theory any type of home loan could have an assumable mortgage clause. Which loans are assumable. Most likely you were looking for a website name and you have typed in this website address to see if its available.

FHA VA and USDA loans can all be assumable. Assumable mortgages allow you to buy a house by taking over assuming the sellers mortgage rather than getting a new mortgage to purchase the property. In July of 2023 the mortgage balance to assume will be 364000.

However only three types of loans typically have this feature. Well heres the good news.

Real Estate Glossary

Assumable Mortgage Real Estate Terms Interest Rate Rise Low Interest Rate

Vj Sudtowqyh6m

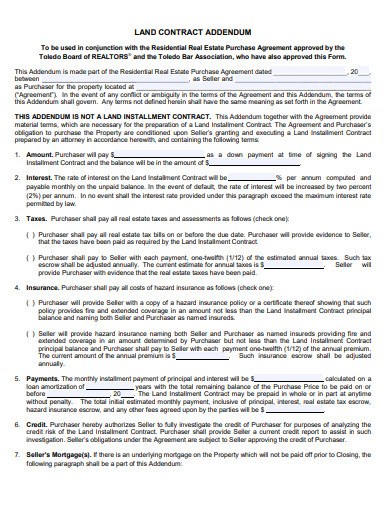

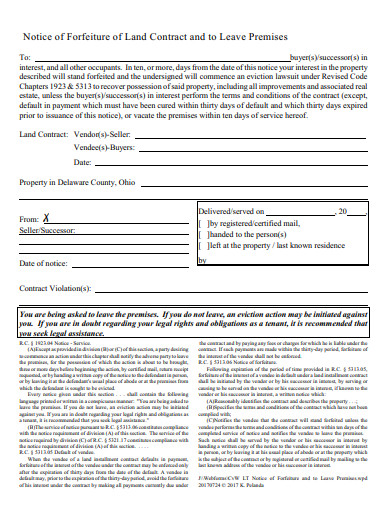

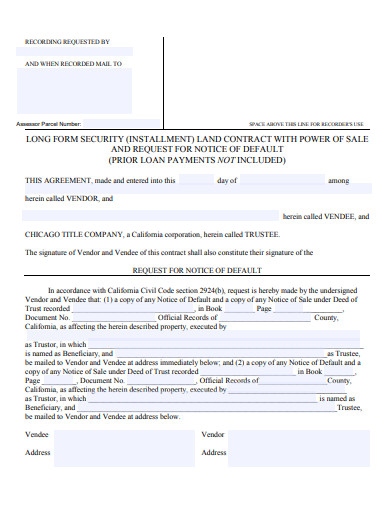

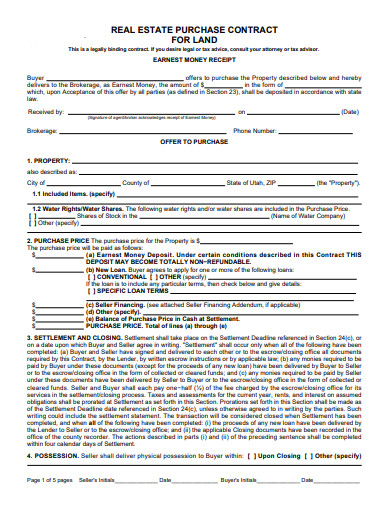

Land Contract Form 10 Examples Format Pdf Examples

Land Contract Form 10 Examples Format Pdf Examples

Land Contract Form 10 Examples Format Pdf Examples

Alisha Stockton Residential Real Estate Professional Home Facebook

New Cheat Sheet On Types Of Mortgages Enjoy Real Estate Infographic Mortgage Cheat Sheets

Alisha Stockton Residential Real Estate Professional Home Facebook

2

Benefits Of Buying A Home With A Va Mortgage Loan

Alisha Stockton Residential Real Estate Professional Home Facebook

Kentucky Fha Loans Compared To Kentucky Conventional Loans Kentucky First Time Home Buyer Programs For 2 Fha Loans Conventional Loan Mortgage Loan Originator

Infographic Benefits Of Fha Loans Infographicbee Com Fha Loans Debt To Income Ratio Fha

Several Useful First Time Home Buyer Options And Resources Fha Loans Refinance Mortgage Fha

Land Contract Form 10 Examples Format Pdf Examples

Vmzepuectdzbem